crypto tax calculator nz

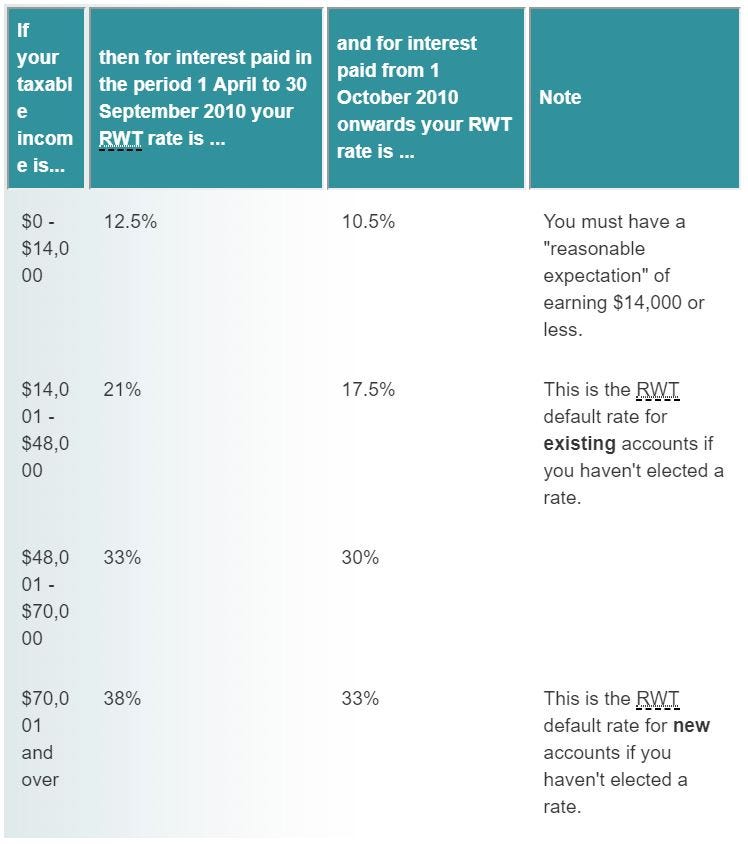

The amount of tax you need to pay depends on how much income you have. Managing consolidated groups Te whakahaere rōpū tōpū.

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe

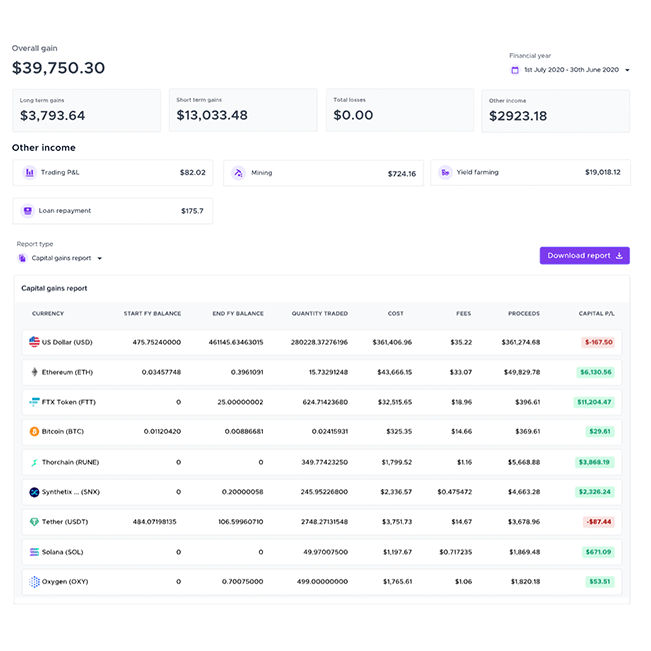

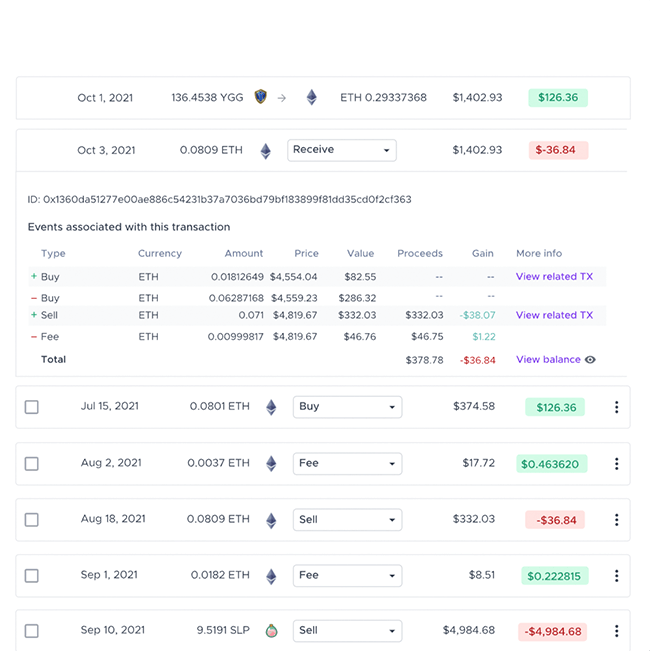

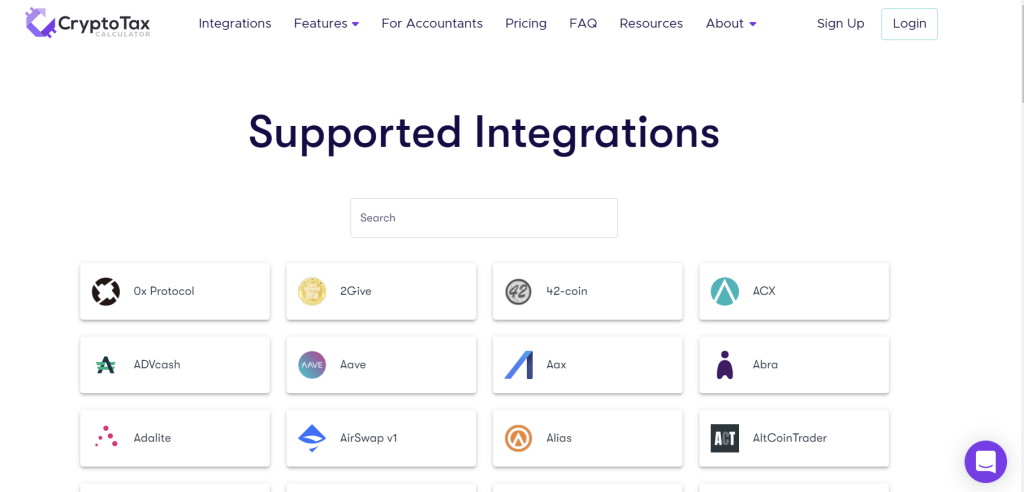

Once youre done importing you can generate a comprehensive crypto tax.

. Built to comply with Aussie tax standards. You need to use amounts in New Zealand dollars NZD when filing your income tax return. Tax reports No more.

Whether youre a crypto newbie or a full-blown degen we have pricing options available for everyones needs and transaction amounts. Taxoshi NZs Crypto Tax Caluclator Founded by the mighty Craig MacGregor co. Check out this table to know how to calculate your taxes.

Koinly helps New Zealanders calculate their income from crypto trading Mining Staking Airdrops Forks etc. In this example the cost basis of the 2 BTC disposed would be 35000 10000 500002. Some cryptoasset transactions may.

In New Zealand if you run a crypto business - that is a business that lets. Before you can put your cryptoasset net income or loss in your tax return. Extension of time arrangements Te whakaroa i ngā whakaritenga wā.

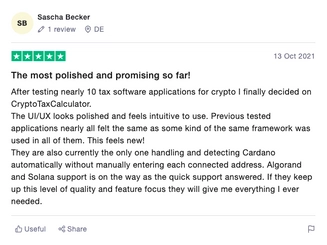

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. We provide tailored and proactive cryptocurrency tax advice to all clients anywhere throughout New Zealand. Tax agent status Te tūnga māngai tāke.

If you are using ACB Adjusted cost base method the cost basis of sale will be determined by. Luckily New Zealand has a service which makes calculating and filing your crypto tax as fast and easy as it should be Taxoshi. You simply import all your transaction history and export your report.

This new rate applies from 1st April. Check out our free guide on crypto taxes in New Zealand. Whether youre a crypto newbie or a full-blown degen we have pricing options available for everyones needs and transaction amounts.

Taxoshi NZs Crypto Tax Caluclator Founded by the mighty. Contact us to ensure you are prepared for tax and have the right strategy in. Calculate Your Crypto DeFi and NFT Taxes in as little as 20 minutes.

Crypto tax in New Zealand for business. New Zealand has a progressive tax rate system and the tax rates. You need to file a tax return when you have taxable income from your cryptoasset activity.

Crypto Tax Calculator for Australia. This means you can get your books. Sort out your crypto tax.

Whether youre a crypto newbie or a full-blown degen we have pricing options available for everyones needs and transaction amounts. Simply connect your accounts and let CoinLedger calculate your gains and losses across all of your transactions. Crypto received from activities such as mining staking and airdrops also attract Income Tax in most cases.

Calculating the New Zealand dollar value of cryptoassets. The cost basis of the 2 BTC disposed is therefore 40000 2 x 10000 500003 in this example. Quick simple and reliable.

Koinly Crypto Tax Calculator For Australia Nz

Coinledger The 1 Crypto Tax Software

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

![]()

Taxoshi Get Your Crypto Tax Under Control

Tax On Investments And Savings In A Nutshell Moneyhub Nz

2019 Paying New Zealand Crypto Tax By Tom B Medium

11 Best Crypto Tax Calculators To Check Out

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

11 Best Crypto Tax Calculators To Check Out

2019 Paying New Zealand Crypto Tax By Tom B Medium

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick

Cryptocurrency And Tax Guide For Nz Easy Crypto

Understanding The Cryptocurrency Tax Rate Taxbit

Crypto Winners Cannot Dodge The Tax Authorities Financial Times